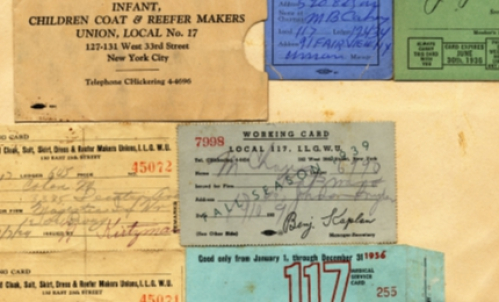

Qualified Charitable Distributions (QCDs/IRAs)

Qualified Charitable Distributions (QCDs), also known as IRA Charitable Rollovers, are the savviest way for individuals age 70½ or older to use their IRAs to maximize their charitable impact.

Gifts made directly from your IRA to YIVO are not subject to federal income tax and count toward your required minimum distribution. 100% of the distribution will go directly to the YIVO Institute for Jewish Research to further our mission to preserve, study, share, and perpetuate knowledge of the history and culture of East European Jewry worldwide.

Individuals can give up to $108,000 from an IRA directly to a qualified charity without having to pay income taxes on the money. To make a QCD gift, contact your IRA custodian. If you intend for your Qualified Charitable Distribution to count for the current tax year, forms need to be processed by December 31, 2025.

Please share details about your intended gift so we can properly provide you with a tax acknowledgment letter when the gift arrives.

Download the Qualified Charitable Distribution confirmation form.

The proper designation for YIVO is as follows:

YIVO Institute for Jewish Research

15 West 16th Street

New York, NY 10011

Federal Tax Identification Number: 13-1641082

For more information, please contact:

Melissa S. Cohen

Chief Development Officer

(212) 294-6156